Vietnam’s power sector is entering a decisive decade that will shape the country’s industrial competitiveness and energy security for generations to come. Electricity demand has grown eightfold since 2002, surpassing 240 TWh in 2022, and is projected to reach 1,200 TWh by 2050 — a fivefold increase driven by rapid industrialization, digital infrastructure, and urbanization.

Under the Power Development Plan VIII (PDP8), Vietnam targets a power system that is both clean and reliable, with CO₂ emissions peaking before 2030 and declining sharply toward net zero by 2050. The latest Energy Transition Partnership (ETP) modelling shows that Vietnam can reduce its power-sector emissions from 250 million tonnes in 2030 to around 30 million tonnes by 2050, provided that structural reforms, investment mobilization, and technology adoption move in tandem.

From Coal to Renewables: A Transforming Generation Mix

Vietnam’s installed capacity stood at roughly 80 GW in 2022 and is expected to double to 158 GW by 2030, then exceed 500 GW by 2050 across all clean energy scenarios. The structure of this expansion represents a fundamental transition away from coal and toward renewables and flexible gas.

In the 2030 horizon, PDP8 anticipates:

- Coal: peaking near 30 GW (25% of capacity) before gradual decline,

- LNG and domestic gas: around 37 GW (30%), serving as transitional baseload,

- Hydropower: maintaining ~29 GW (18%),

- Solar PV: rebounding to ~27 GW (17%),

- Wind: rapidly expanding to ~22 GW combined (onshore and offshore).

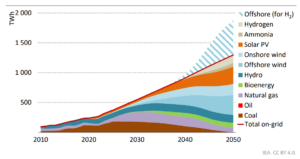

Electricity generation by source under the PDP8 scenario (2010–2050)

By 2050, renewables dominate the power landscape:

- Solar PV surges to 170–190 GW, becoming the largest contributor (~25% of generation),

- Offshore wind grows to 70–90 GW, a cornerstone of coastal provinces’ development,

- Hydropower stabilizes around 30 GW,

- Gas and hydrogen-based generation reach 35–40 GW, 80% of which are hydrogen or ammonia-fueled,

- Biomass and other low-carbon fuels add another 15 GW,

- Coal is entirely phased out.

Renewables (including hydropower) are expected to account for 65–70% of total generation by 2050, compared with less than 20% today — marking one of the most ambitious transitions in Asia.

Powering Industry and Digital Growth

Electricity is the lifeblood of Vietnam’s industrial economy. The industrial sector consumes roughly 55% of total electricity, led by manufacturing, steel, cement, and electronics. Over the next decade, this profile will evolve further as data centres, semiconductor plants, and battery production emerge as major new loads.

The ETP projects that industrial electricity demand will exceed 400 TWh by 2030 and could surpass 850 TWh by 2050. Meanwhile, residential and commercial sectors together are expected to add another 300 TWh, fueled by air-conditioning, e-mobility, and urban expansion.

Particularly, the rise of data centres is reshaping grid planning. By 2030, data centre capacity may reach 1.5 GW, scaling up to 6–8 GW by 2050. These facilities are increasingly turning to Direct Power Purchase Agreements (DPPA) and on-site renewable solutions to ensure clean and reliable supply.

Investment, Policy, and Market Reform

To meet these targets, Vietnam will require massive investment averaging 30 billion USD per year to 2030, rising to 40–60 billion USD annually in the 2040s. Around half of this must go into generation, with the rest directed to transmission, storage, and flexibility assets such as BESS and HVDC lines.

Several enabling frameworks are taking shape:

- Competitive Power Market Roadmap (ERAV/MOIT) aims to open wholesale and retail competition.

- DPPA Decree (No. 80/2024/NĐ-CP) provides a foundation for corporate renewable procurement.

- Green finance mechanisms — from JETP facilities to green bonds and asset-backed securities — are being designed to mobilize private capital at scale.

These reforms mark Vietnam’s gradual shift from a state-led model toward a market-oriented, investment-driven power sector, capable of attracting both domestic and foreign participation.

Challenges Ahead: Flexibility, Grid Stability, and Bankability

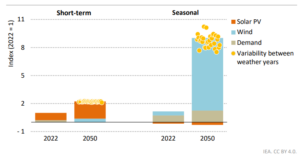

As the share of renewables increases, grid flexibility becomes the defining challenge. Curtailment and congestion are already pressing issues in southern and central provinces.

ETP simulations show that without large-scale storage deployment (batteries, pumped hydro) and flexible backup capacity, renewable integration could stall beyond 2030.

Short-term and seasonal flexibility needs in Viet Nam’s power system: 2022 vs. 2050

In parallel, financial and contractual risks persist. Standardized PPAs, creditworthy offtakers, and clear pricing mechanisms are needed to unlock private investment — particularly for C&I (commercial & industrial) consumers.

Maintaining power reliability amid decarbonization will require synchronized action:

- Expanding inter-regional transmission capacity,

- Integrating flexibility markets and demand response,

- Developing hydrogen-ready gas infrastructure,

- Enhancing digital control and forecasting systems.

Vietnam’s energy future depends not just on how much capacity it adds, but on how efficiently it manages, stores, and delivers every kilowatt-hour.

Conclusion

Vietnam’s power transition represents both an industrial opportunity and an infrastructure challenge. By 2050, the country can achieve a decarbonized electricity system that powers sustainable growth — but only through coordinated investment in renewables, grids, and market reform.

As the IEA frames it, the “Age of Electricity” is already underway — and Vietnam stands at its forefront in Southeast Asia, balancing growth, reliability, and sustainability.

📚 Sources

International Energy Agency (IEA).

Electricity 2025: Analysis and Forecast to 2027. Paris: IEA, 2025.

🔗 https://www.iea.org/reports/electricity-2025

International Energy Agency (IEA) & Viet Nam Ministry of Industry and Trade (MOIT).

Achieving a Net Zero Electricity Sector in Viet Nam: Technical Report.

Paris: IEA, 2024.

🔗https://www.iea.org/reports/achieving-a-net-zero-electricity-sector-in-viet-nam